Vietnam’s logistics industry has become one of the brightest stars in Southeast Asia, capturing the attention of international investors with its impressive growth rate and long-term potential. Growing at an annual rate of 14-16%, Vietnam’s logistics market is projected to exceed $65 billion by the decade's end, offering immense opportunities for foreign businesses.

Strong Market Growth

Vietnam’s logistics sector has emerged as one of the fastest-growing industries, significantly contributing to the country’s economy. The market is valued at $45.2 billion in 2023 and is expected to surpass $65 billion by 2030. This growth is primarily driven by the booming e-commerce sector, which has become one of the most dynamic industries in the country.

The rise of major e-commerce platforms such as Shopee, Lazada, Tiki, Sendo, and TikTok Shop has significantly increased demand for storage, transportation, and supply chain management services. In the first half of 2024, these platforms generated total revenues exceeding $6 billion, highlighting the growing need for robust logistics infrastructure.

Notably, e-commerce growth is no longer confined to major cities. It has expanded to rural areas, where logistics infrastructure still holds significant development potential. With an estimated 67 million smartphone users by 2026, the demand for logistics services will continue to grow nationwide.

Vietnam’s e-commerce market is the third largest in Southeast Asia

Geographical Advantages and Trade Agreements

Vietnam’s strategic location in ASEAN positions it as a critical hub connecting Southeast Asia with global markets. The country’s proximity to key trade routes further enhances its logistics potential.

In addition, Vietnam has signed numerous free trade agreements (FTAs), including significant agreements with the European Union (EU) and countries within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements reduce trade barriers and create opportunities for foreign logistics businesses to access Asian and European markets.

Low operating costs, especially warehouse leasing, add to Vietnam’s appeal. According to TMX, Vietnam boasts the second-lowest warehouse operating costs in Southeast Asia, offering a competitive edge over other countries.

High-Potential Segments

Warehousing

Warehousing remains a key area of interest for foreign investors. Nearly 75% of Vietnam’s leasable warehouse space is controlled by international investors, including major players like Mapletree (Singapore), BW Industrial (backed by Warburg Pincus), and SEA Logistic Partners (GLP Capital). These companies have successfully developed warehousing solutions to meet the growing demands of e-commerce and manufacturing sectors.

Despite increasing competition, the potential for growth in warehousing remains significant, driven by rising demand for storage solutions and supply chain optimization.

Nearly 75% of warehouse space for lease in Vietnam is owned by international investors.

Cold Chain Logistics

Cold chain logistics is another promising segment yet to be fully explored. As a leading exporter of agricultural products, seafood, and pharmaceuticals, Vietnam needs cold storage facilities and refrigerated transportation.

Although building and operating cold storage is capital-intensive and technologically demanding, the potential returns are handsome. This presents a lucrative opportunity for companies with the capability and willingness to invest in this niche market.

Outsourced Logistics (3PL and 4PL)

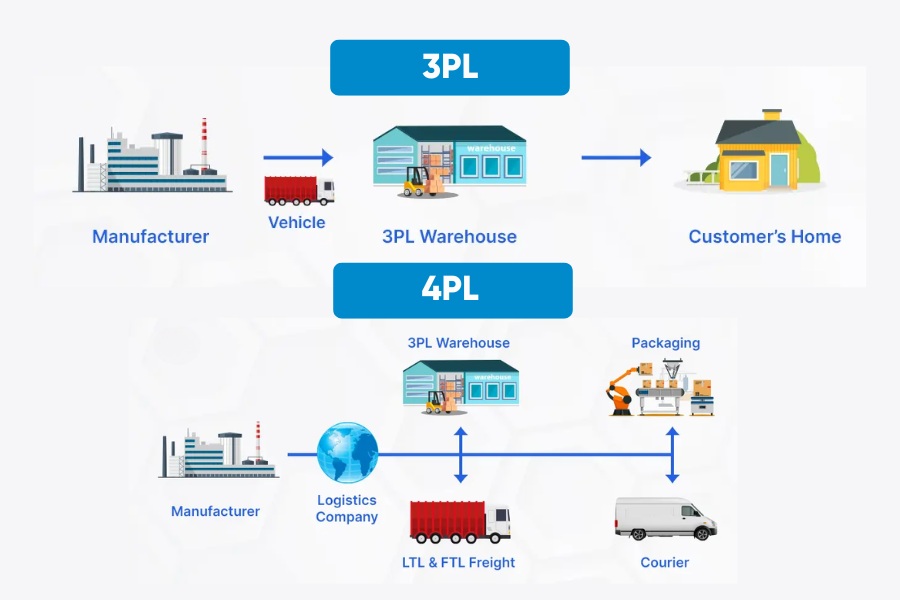

Outsourced logistics services, including third-party logistics (3PL) and fourth-party logistics (4PL), are also drawing significant attention.

- 3PL focuses on specific supply chain functions such as transportation and warehousing.

- 4PL, on the other hand, provides integrated supply chain management, overseeing the entire logistics operation for clients.

- The rising preference for 4PL services reflects the growing demand for comprehensive, cost-effective logistics solutions.

3PL and 4PL are two main logistics segments attracting foreign investors.

Long-Term investment potential

Experts predict continued growth in Vietnam's warehousing, outsourced logistics, and cold chain logistics. E-commerce alone is expected to grow by up to 30% annually, creating substantial opportunities for logistics providers. Specialized sectors such as cold chain transport and integrated supply chain management will attract long-term investors.

The Vietnamese government has also taken proactive measures to address existing challenges. Resolution No. 163/NQ-CP focuses on improving infrastructure, reducing logistics costs, and streamlining administrative procedures. Meanwhile, green logistics initiatives like renewable energy-powered warehouses are gaining traction among international investors.

Conclusion

Vietnam’s logistics industry is on a robust growth trajectory, with the potential to become the logistics hub of Southeast Asia. Continuous improvements in infrastructure, favorable trade policies, and sustainable development initiatives make Vietnam an increasingly attractive destination for international investment.

For foreign businesses with a long-term perspective, Vietnam offers a golden opportunity to tap into one of the most dynamic logistics markets in the region.