From January 1, 2026, regulations on the sanctioning of administrative violations in the field of charges and fees have undergone significant changes under Decree 02/2026/ND-CP. To support enterprises in proactive financial planning and ensure smooth customs clearance, PCS Logistics provides the following updated overview of regulations on customs fee payment.

1. Types of violations and applicable penalty frameworks

Decree 02/2026/ND-CP clearly prescribes sanction levels for different groups of violations related to charges and fees.

1.1. Violations of regulations on payment of charges and fees (Article 17)

These violations apply where charge or fee payers fail to fulfill payment obligations on time, resulting in an underpaid amount.

Caution: A caution is applied where the obligation to pay charges or fees is violated, but does not result in an underpaid amount.

Fines for violations resulting in underpayment

|

Underpaid amount (VND) |

Fine applicable to organizations |

|

Below 10,000,000 |

1,000,000 – 2,000,000 |

|

10,000,000 to under 30,000,000 |

2,000,000 – 5,000,000 |

|

30,000,000 to under 50,000,000 |

5,000,000 – 7,500,000 |

|

50,000,000 to under 100,000,000 |

7,500,000 – 15,000,000 |

|

100,000,000 to under 300,000,000 |

15,000,000 – 40,000,000 |

|

300,000,000 or more |

40,000,000 – 50,000,000 |

Note: The maximum fine applicable to organizations in the field of charges and fees is VND 100,000,000.

1.2. Violations of regulations on declaration of charges and fees (Article 16)

These violations apply to errors in declarations or delays in the charge and fee declaration process.

|

Violation |

Fine |

|

Late declaration or incomplete declaration (first violation) |

Caution |

|

Late declaration or incomplete declaration (repeat violation) |

VND 500,000 – 1,000,000 |

|

Failure to declare charges or fees as prescribed |

VND 3,000,000 – 5,000,000 |

1.3 Violations of regulations on exemption and reduction of charges and fees (Article 11)

These violations apply where enterprises improperly declare information in order to obtain charge or fee exemptions or reductions.

|

Violation type |

Penalty |

|

Improper declaration to obtain charge or fee exemption or reduction |

Fine equal to 20% of the exempted or reduced amount (minimum VND 500,000, maximum VND 50,000,000) |

|

Improper application of charge or fee exemption or reduction |

Fines applied in accordance with regulations on underpayment, ranging from VND 500,000 to VND 50,000,000 depending on the underpaid amount |

2. Mandatory remedial measures

In addition to fines, violators shall be subject to remedial measures, including:

-

Forcible remittance of outstanding charges and fees into the state budget

-

Payment of late payment interest in accordance with the Law on Tax Administration

-

Forcible refund to payers in cases where charge or fee exemption or reduction is improperly applied

Compliance with regulations on charges and fees supports operational efficiency and reinforces enterprise credibility with customs authorities.

PCS Logistics recommends that enterprises:

-

Review existing customs fee payment procedures

-

Where monthly consolidated payment is applied, establish internal payment reminders prior to the 10th day of each month to ensure compliance with Decree 02/2026/ND-CP

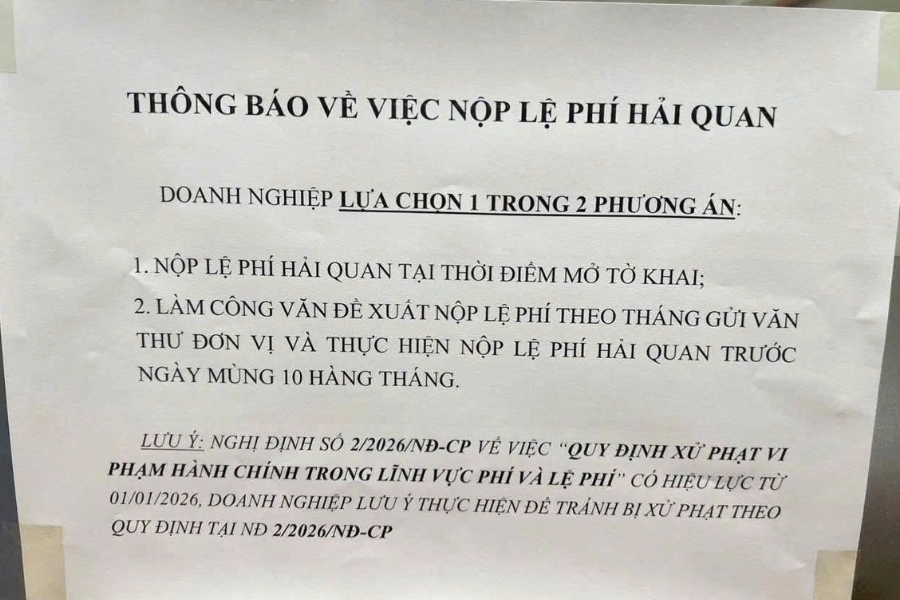

3. Customs fee payment options for enterprises

According to guidance from customs authorities, enterprises may choose one of the following payment options:

-

Option 1: Pay customs fees directly at the time of customs declaration registration.

-

Option 2: Register for monthly consolidated payment by submitting an official request letter to the customs authority. Payment must be completed before the 10th day of each month.

If you have any questions regarding customs procedures or require support for international express operations, please contact PCS Logistics:

-

Hotline: 1900 545 428

-

Email: support@pcs-logistics.com

Our customs compliance support helps enterprises align declaration procedures, fee payment methods, and documentation with the latest regulatory requirements.

References:

[1] Guidance on customs fee payment issued by Hai Phong Customs Department (KV03)

[3] State Treasury account list for tax and fee payment (latest update)

[4] Template for monthly customs fee payment registration letter